2022 tax brackets

14 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000. For 2018 they move down to the 22 bracket.

Read on to see whats in store for 2023.

. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. 1 day agoThe 2023 changes generally apply to tax returns filed in 2024 the IRS said. Americas tax brackets are changing thanks to inflation.

The federal income tax rates remain unchanged for the 2021 and 2022 tax years. MarriedFiling jointly and qualifying widow ers. And the alternative minimum tax exemption amount for next.

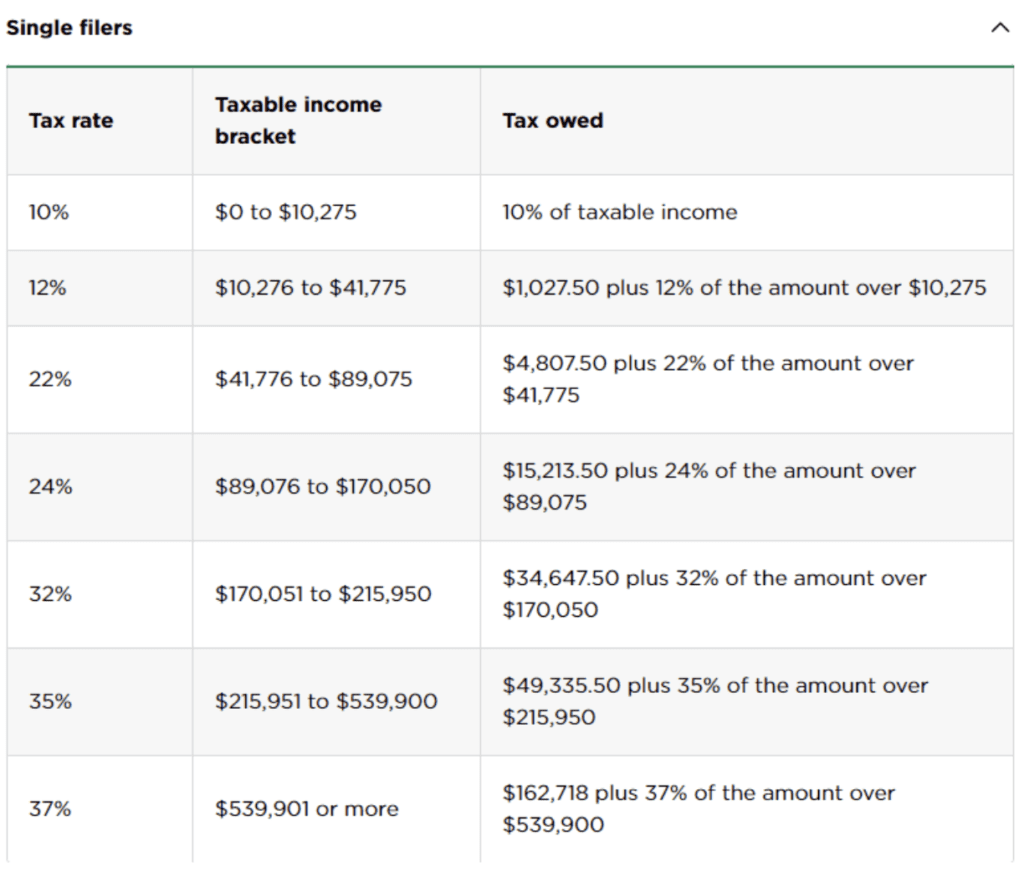

Whether you are single a head of household married. 75901 to 153100 28. Taxable income between 10275 to 41775.

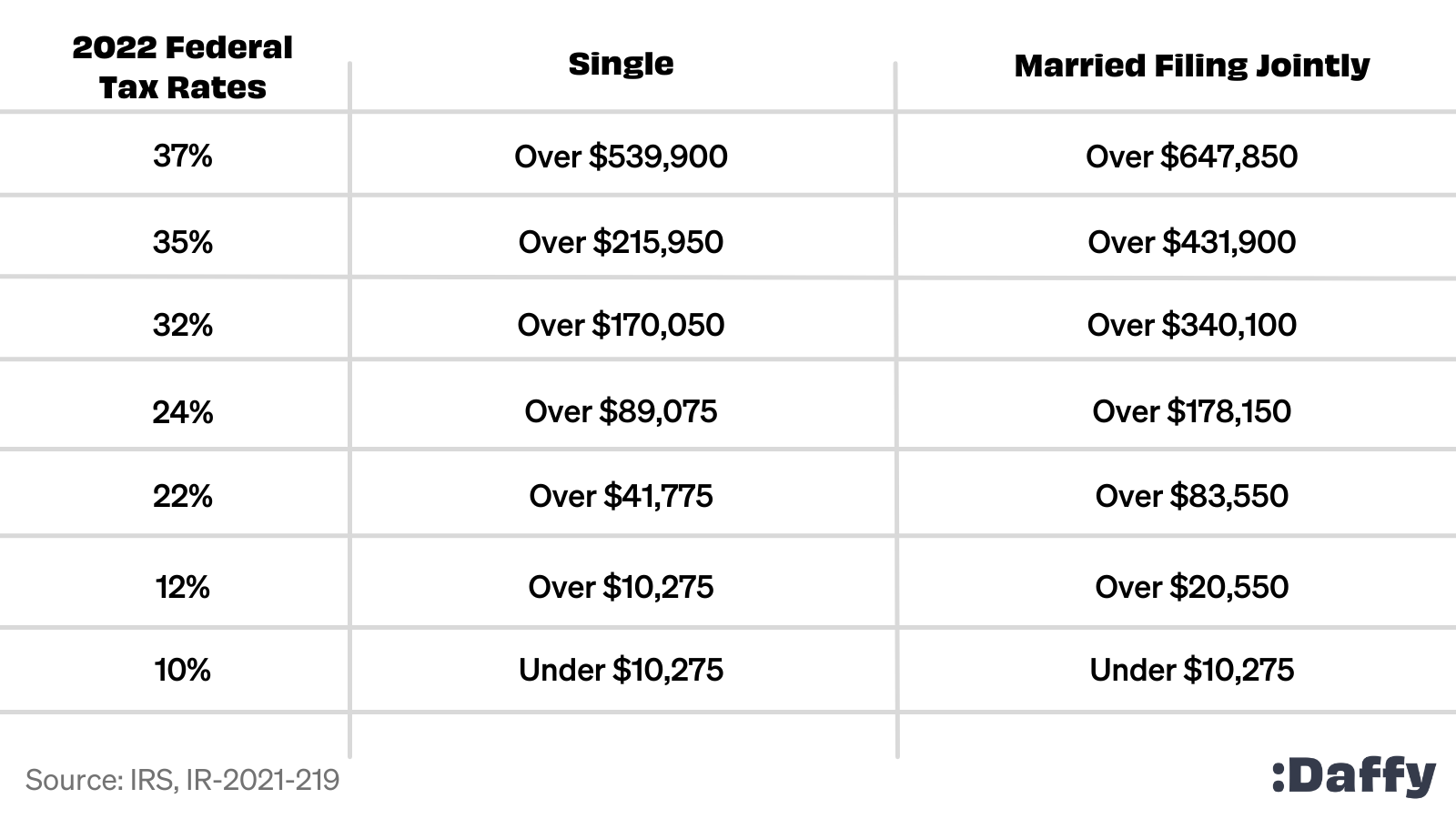

Over 14650 but not over 55900. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and ends. 10 12 22 24 32 35 and.

The 2022 and 2021 tax bracket ranges also differ depending on your filing status. 11 hours agoTax brackets can change from year to year. 7 rows There are seven federal tax brackets for the 2021 tax year.

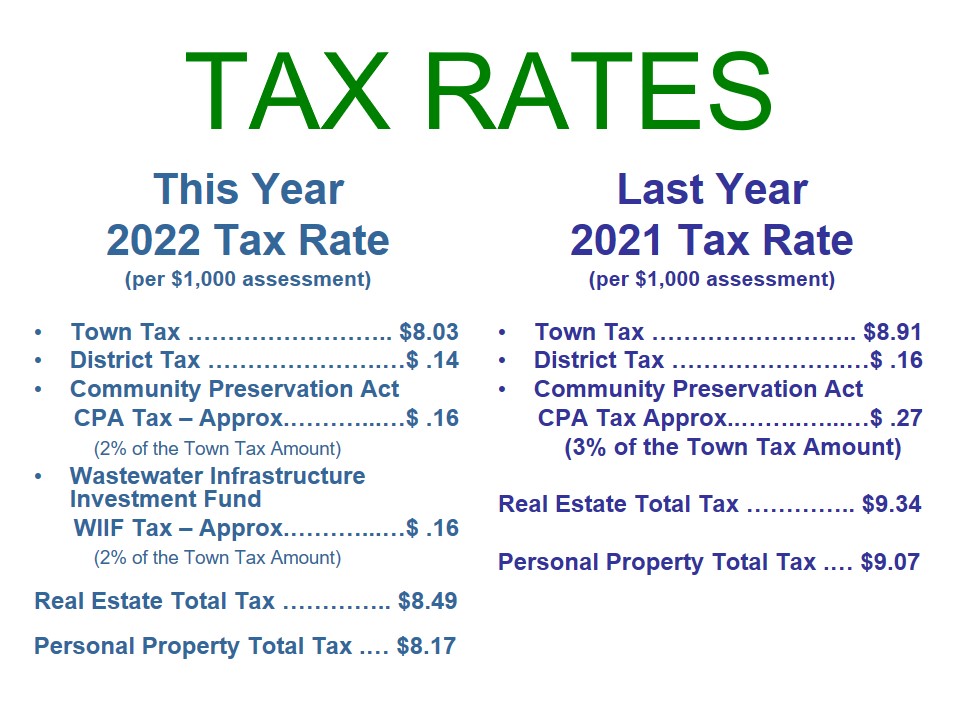

Over 55900 but not over 89050. 2022 New Jersey Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly.

1465 plus 12 of the excess over 14650. The income brackets though are adjusted. 11 hours agoThe 24 bracket for the couple will kick in at 190750 up from 178150 and the highest 37 rate will hit taxable income exceeding 693750 up from 647850 in 2022.

1 day agoThe IRS will exempt up to 1292 million from the estate tax up from 1206 million for people who died in 2022 an increase of 71. Trending News Abbott recalls more baby. They dropped four percentage points and have a fairly significant.

Lets review the standard deduction. There are seven federal income tax rates in 2023. Tax on this income.

17 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits. Heres a breakdown of last years. Each of the tax brackets income ranges jumped about 7 from last years numbers.

The agency says that the Earned Income. From 6935 for the 2022 tax year to 7430 in 2023. Taxable income up to 10275.

The IRS recently released the new tax brackets and standard deduction amounts for the 2022 tax year the tax return youll file in 2023. 10 of taxable income. Compare your take home after tax and estimate.

10 12 22 24 32 35 and 37. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. 77400 to 165000 22.

13 hours ago2022 tax brackets for individuals. Of the amount over. Below are the new brackets for both individuals and married coupled filing a joint return.

If taxable income is over. Taxable income between 41775 to 89075. Resident tax rates 202223.

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

The Complete 2022 Charitable Tax Deductions Guide

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

State And Local Sales Tax Rates Midyear 2022

2022 Income Tax Brackets And The New Ideal Income

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

The Truth About Tax Brackets Legacy Financial Strategies Llc

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

2022 Tax Brackets How Inflation Will Affect Your Taxes Money

Corporate Tax Rate Schedule Tax Policy Center

How To Adjust For Tax Inflation In 2022 Iccnv Las Vegas Nv

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

Tax Changes For 2022 Including Tax Brackets Acorns

Understanding Marginal Income Tax Brackets The Wealth Technology Group

/cloudfront-us-east-1.images.arcpublishing.com/gray/CDS3MAEWJVCTHB6SLZQ3KZXGMM.jpg)